"Things might get worse before they get better - and eventually settle at a less optimal level - due to the seismic shift in global trade relations"

Is it time to position for a global economic meltdown?

Global growth faces two major geopolitical threats. The US-China trade war and the rise of populism in Europe have ushered in a new era of market sensitivity. But beyond short-term fluctuations, are they having a significant impact on growth?

Earlier this year, China and Europe both displayed tentative signs of stabilisation, but recent data has failed to confirm the expected pickup in activity. While this may appear to be linked to macro events, investors need to distinguish the impact of political developments on market volatility from their impact on growth, to understand the implications for asset allocation.

A structural shift

The US-China trade war has been a game-changer. It has challenged the established order of trade relations and opened a ‘Pandora's Box' of renegotiations from which the most hopeful outcome will not be a return to the globalised world order.

This structural shift has ushered in a new paradigm of renewed market sensitivity. Additionally, the recent escalation in US-China tensions has increased downside risks and added uncertainty headwinds to the growth outlook. While we believe rationality will ultimately prevail, the tail risk has also grown whereby national pride will become the main driver in negotiation processes.

In Europe, the rise of populism is ubiquitous, evidenced by recent European Parliament elections and the ongoing Brexit

Learn More

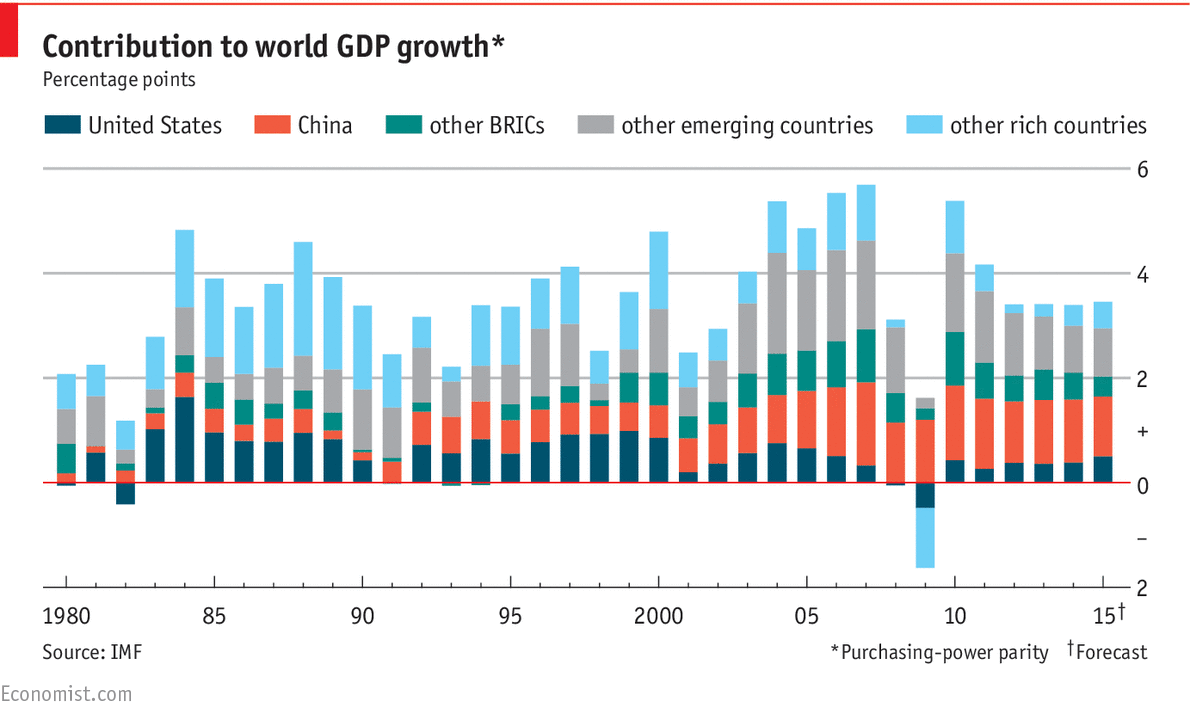

IMF 2019 OUTLOOK