"the next downturn will likely be broad-based and not limited to an acute financial crash, as it is set to be “a more typical economic correction at the end of a cycle”."

‘Southeast Asia at risk of faring worse in next downturn than in global financial crisis’

BAIN & CO. ANALYSTS

SINGAPORE — Southeast Asia is more vulnerable to an economic downturn than it was during the global financial crisis one decade ago, according to analysts at global management consultancy Bain & Co.

Greater exposure to a slowing China – and other structural economic shifts – have left most Asean markets in a more perilous position than before, according to a report released on Friday.

Half of the region’s economies have fallen into a current account deficit as exports tumbled, while Vietnam and the Philippines were the only two countries not to post lower growth in 2018.

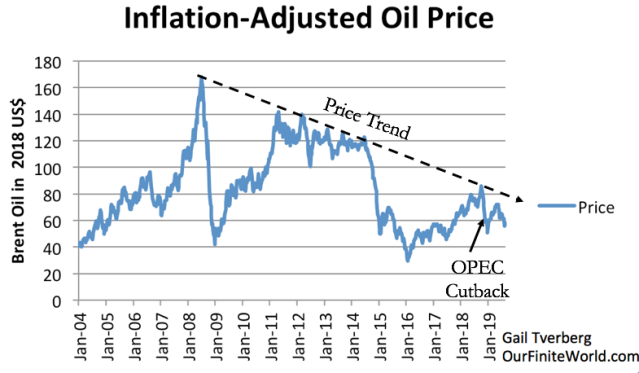

The commodities sector will not be as able to cushion the economic blow, as prices and sales are both down, while corporate and household debt have blown past 2008 and 2009 levels to reach the private-sector leverage of more developed markets such as the United States.

“The region’s strong economic growth does not, in fact, shelter it from harm should other parts of the world sink into a downturn or even a recession,” said the report.

ASIA ECONOMIC OUTLOOK