"What economists around the world get wrong about the future."

THE FALLACY OF ENDLESS ECONOMIC GROWTH

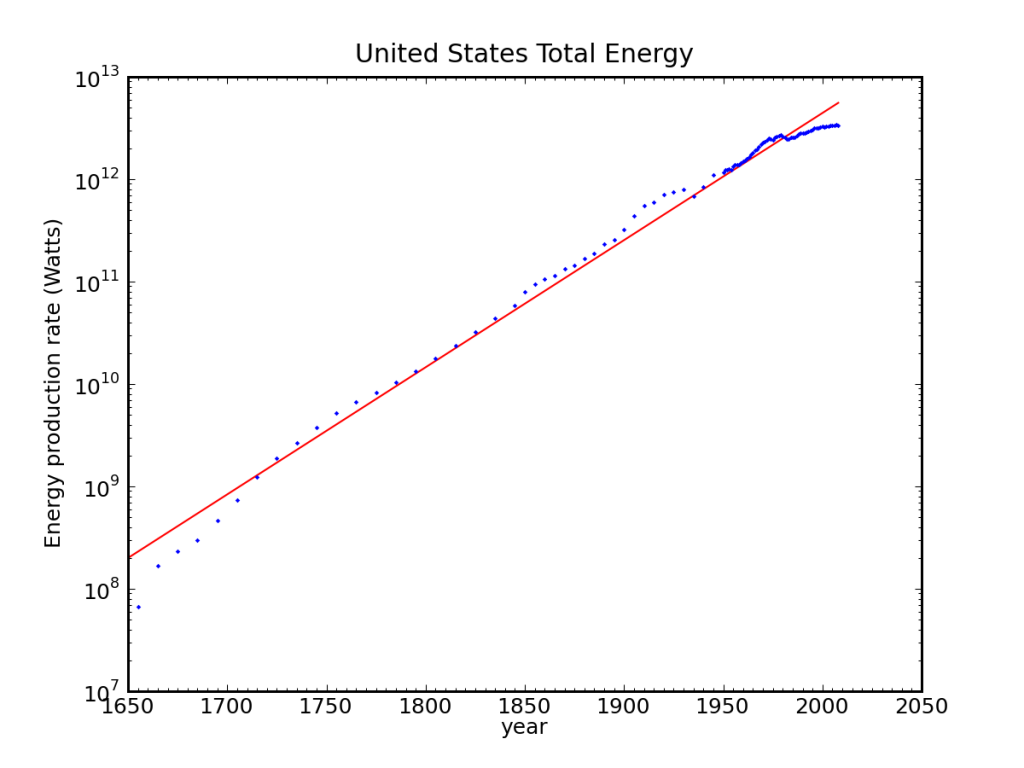

The idea that economic growth can continue forever on a finite planet is the unifying faith of industrial civilization. That it is nonsensical in the extreme, a deluded fantasy, doesn't appear to bother us. We hear the holy truth in the decrees of elected officials, in the laments of economists about flagging GDP, in the authoritative pages of opinion, in the whirligig of advertising, at the World Bank and on Wall Street, in the prospectuses of globe-spanning corporations and in the halls of the smallest small-town chambers of commerce. Growth is sacrosanct. Growth will bring jobs and income, which allow us entry into the state of grace known as affluence, which permits us to consume more, providing more jobs for more people producing more goods and services so that the all-mighty economy can continue to grow. "Growth is our idol, our golden calf," Herman Daly, an economist known for his anti-growth heresies, told me recently.

In the United States, the religion is expressed most avidly in the cult of the American Dream. The gatekeepers of the faith happen to not only be American: The Dream is now, and has long been, a pandemic disorder. Growth is a moral imperative in the developing world, we are told, because it will free the global poor from deprivation and disease. It will enrich and educate the women of the world, reducing birth rates. It will provide us the means to pay for environmental remediation—to clean up what so-called economic progress has despoiled. It will lift all boats, making us all rich, healthy, happy. East and West, Asia and Europe, communist and capitalist, big business and big labor, Nazi and neoliberal, the governments of just about every modern nation on Earth: All have espoused the mad growthist creed.

LEARN MORE

WHY DON'T WE APPLY EXPONENTIALS TO OUR EXISTENTIAL LIMITS?