Sapphire Raises $1 Billion for Investment in Start-Ups

Sapphire Ventures has closed on a $1 billion fund to invest in privately held start-ups, easing fears about a downturn in the venture capital industry.

Sapphire Ventures, a venture capital firm in Palo Alto, Calif., with more than $2.4 billion in assets under management, has only one investor, the business software maker SAP. Sapphire Ventures was the corporate venture arm of SAP, and it has operated as a stand-alone firm since 2011.

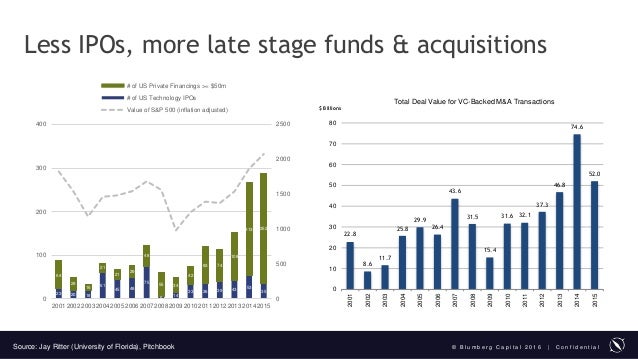

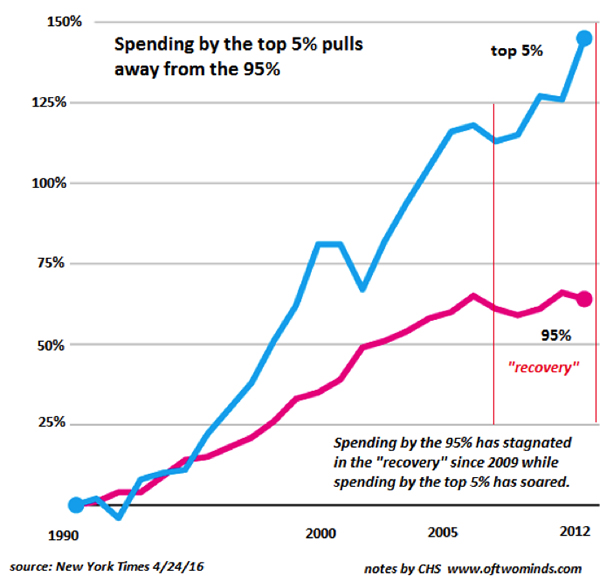

For the last year, investors have worried that the venture industry had become overheated and that there would be a freeze in fund-raising. But like Sapphire Ventures, several firms have raised more than $1 billion this year, giving them firepower to write big checks for start-ups, whose valuations peaked around the end of 2015.

Last month, Technology Crossover Ventures announced a $2.5 billion fund. Earlier this year, Kleiner Perkins Caufield & Byers raised $1.4 billion across two funds and Andreessen Horowitz raised $1.5 billion. Founders Fund also raised $1.3 billion, Accel Partners garnered $2 billion and Norwest Venture Partners raised $1.2 billion.

In the United States alone, the venture industry raised nearly as much money in the first half of 2016 as it did in all of 2015, according to data from Thomson Reuters and the National Venture Capital Association.

Sapphire Ventures invests in start-ups that are past their earliest stages, and 38 of the companies that it has put money into went public or were sold since 2011, including the online storage company Box, the wearables maker Fitbit and the mobile payments company Square.