Is US Dollar Crash Possible?

Summary

The U.S. dollar index has been on the rise thanks to Fed officials talking up rate hikes.

Propping up the U.S. dollar by the Fed is referred to as a “Fed Dollar Put”.

The Fed may have already painted themselves into a corner about rate hikes.

A no June rate hike decision may cause a dollar collapse as speculators pile onto short positions.

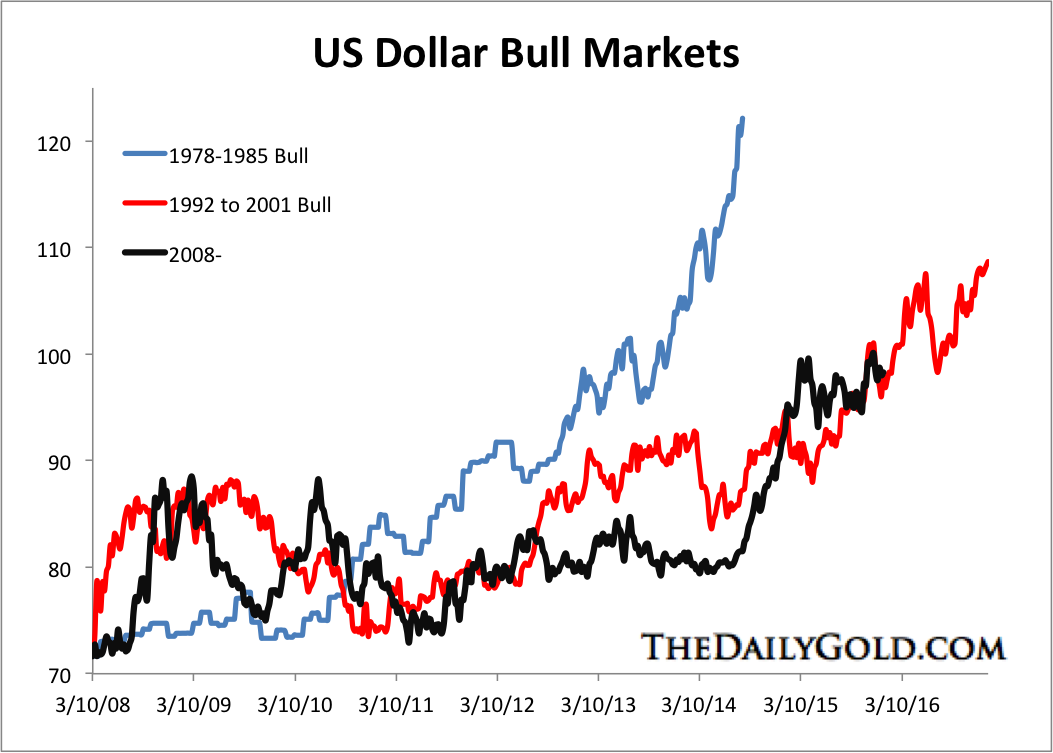

The U.S. dollar index, or DXY, a weighted index of the value of the U.S. dollar relative to a basket of six major currencies, has bounced 3.72% since its 15-month low on May 3, when Atlanta Fed President Dennis Lockhart and his San Francisco Fed colleague John Williams told reporters that U.S. financial markets may be underestimating the odds of a central bank rate increase at the June 14-15 Federal Open Market Committee, or FOMC, meeting.

The U.S. dollar index, or DXY, a weighted index of the value of the U.S. dollar relative to a basket of six major currencies, has bounced 3.72% since its 15-month low on May 3, when Atlanta Fed President Dennis Lockhart and his San Francisco Fed colleague John Williams told reporters that U.S. financial markets may be underestimating the odds of a central bank rate increase at the June 14-15 Federal Open Market Committee, or FOMC, meeting.