Investors' Insights:

Week Ending March 23, 2013

FIRST FINANCIAL INSIGHTS

"Investors' Insights"

First Financial Insights

March 20, 2013

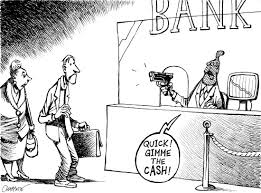

What if your bank shut down, then gave 10% of your (and everyone’s) money to the government? This just happened in Cyprus.

This deposit seizure is a very serious matter and policy event that has far-reaching economic and investment implications on a number of fronts; as it sets a dangerous precedent for banks, brokerages, pensions, insurance companies and all other forms and shapes of financial concerns around the world. What happened in Cyprus, could it also occur anywhere in the world - as desperate governments are forced to take harsh illegal actions that violate all forms of commercial law, regulation, ethics and fair economic principles? Who can answer this question now?

Cyprus opens the door to a jackpot of issues that occurs when governments legitimize the outright theft of deposits and assets from bank accounts within their jurisdictions. This is theft of the worst form. For it undercuts the " Rule of International Law " and thereby all confidence in engaging in financial transactions with international bodies or their banking agents. Should this "illegitimate tactic" spread to other European jurisdictions, then the whole financial system could collapse in just a few days, as a panic moves from country to country - and therein; bank to bank.

Let's remember too, that Cyprus is not a third world country under the control of a socio-pathic despot. Its actions appear to have the tacit approval of the EU and ECB. The implications of which place the whole European banking, brokerage and commercial system in "grave jeopardy" - leading to a possible collapse in EU financial markets and systems due to fears of more deposit seizures.

The amount, extent, and rippling effects of the theft of banking deposits or assets by any government is so devastating that immediate measures, sanctions and condemnations must come forward from all world governments, financial institutions and regulatory bodies. Or else we risk seeing the beginning of a wide-spread fear that has the potential to snowball out of control.

Why? Because the question everyone will be asking is: Who's next? Italy? Spain? Greece? Ireland? Portugal? Savvy investors, banks, funds and institutions are sure to start readjusting their positions next week (many did over the weekend no doubt) before the markets open Monday and banks in Cyprus reopen on Thursday. We, hence, expect major outflows and realignments of capital out of marginal EU nations should no counter-measures be applied.

What Cyprus has done is completely unacceptable and thus harsh measures are needed to correct this violation or else the whole global financial system risks a collapse. The problem is that even if measures are taken to fix this immediately; it has created a "whole new fear or risk" in the minds of investors regarding the safety of funds in banks and institutions in Europe, - or perhaps everywhere. This is the last type of policy action one could imagine in such a fragile economic environment. Markets are sure to respond with deep concern.

This is potentially far worse than the crisis that was caused by the Lehman Bros fiasco and we have consequently issued a Market Warning to all our clients, readers and followers for this week. Of course, we will be following and commenting on events as they unfold.

So, we too say, "Be careful out there"

INVESTORS' INSIGHTS

First Financial Insights

March 17, 2013

“NEWS ALERT ”

This is getting to be worse than the Wild,Wild West or the Lehman Bros. fiasco of 2008. Where was the EU and ECB oversight in the first place? Does the ECB, EU and IMF not have any regulatory metrics in place to detect or prevent such issues from ever reaching this stage?. Granted Cyprus is less than .2% of the EU's GDP, but still, could you imagine the US not bailing out Rhode Island? Or Canda PEI? The message would be clear: "there is no political union nor governing Central Bank".

This is the absolute wrong message for the EU and ECB to be sending ,when they will be facing crisis after crisis in the months ahead. Bond markets should be shrivering, as these new frontiers are openiing unknown, unknowns with the potential to dominoe into the global system. Trigering the much feared rise in interest rates around the world.

Whatever bailout funds Cyprus had expected it needed, is now sure to be much larger as every depositor with a heart beat will be looking to withdraw their funds as soon as possible. Some sources say the Russians have as much as $65 billion on deposit, that they could be wanting to pull out the moment the bank doors open.on Tuesday. This could therefore get much uglier.

Is it the beginning of the end for the whole EU experiment? It does not look promising.

This is the absolute wrong message for the EU and ECB to be sending ,when they will be facing crisis after crisis in the months ahead. Bond markets should be shrivering, as these new frontiers are openiing unknown, unknowns with the potential to dominoe into the global system. Trigering the much feared rise in interest rates around the world.

Whatever bailout funds Cyprus had expected it needed, is now sure to be much larger as every depositor with a heart beat will be looking to withdraw their funds as soon as possible. Some sources say the Russians have as much as $65 billion on deposit, that they could be wanting to pull out the moment the bank doors open.on Tuesday. This could therefore get much uglier.

Is it the beginning of the end for the whole EU experiment? It does not look promising.

Investors' Insights

First Financial Insights

Comments

The Globe and Mail

Toronto, ON

March 22, 2013

March 22, 2013

Unknown, Unknowns

Jimmy says it all in this television interview. Worth listening to his comments for five minutes. Right now, the stock markets are enjoying a "trillion dollar money printing party" that is creating loads of liquidity to keep the stock soaring fervour alive. It will not last forever. And as Jim says, when the printing stops and they turn out the lights - it will be very bad for everyone. Very Bad.

Here's the kicker. There is not much difference between the Cyprus deposit tax and the debasement or dilution of wealth created by the printing of money.One approach is direct, while the other is quieter and invisible. Nonetheless the effects are exactly the same; banksters get their pound of flesh.

Something to think about this weekend.

First Financial Insights

March 21, 2013

One way or another...

Not often do we comment on Real Estate, but it still remains one our favoured investment strategies against stock, bond, economic, political and currency risks. The Miami boom has been underway pretty much since the 2008 meltdown, when prices plummeted to 30 to 40% of construction costs on a per square foot basis. Buyers from all over the world flocked to the market cherry picking properties with cash or foreign credit, as the US banks were basically shut down, thereby limiting access to US buyers. Talk about shooting fish in a barrel.

Anyway the best of the bargains are pretty much done in Miami, but Real Estate still offers a long-term hedge against sovereign political, economic and currency risk. For instance, would you hold on to your $10 million (Cdn) Villa in Spain, Greece, Cyrus or Italy; or rather own a $5 million dollar Chalet in Whistler, BC and a $5 million residence Australia? Why? The relative value of these two currencies should increase dramatically as global resources dwindle and the currencies of resource poor nations decline with their gloomy economic prospects.

Adam Smith recognized that the value of real estate is a function of the surrounding economic activity, infrastructures and prospects. Currency values embed this idea and thus sticking to nations with the higher ratio of resources (hard assets) per capita offer better long-term protection of your global purchasing power. The intrinsic hard-asset wealth ratio, is also a better metric and is more important than GDP - because you achieve comfort regarding sustainable economic activity.

While unique opportunities come and go, proper long-term positioning of realty portfolios should always remain foremost in mind. Even positioning as alternatives to stocks, bonds and precious metals needs to be considered. So determining the long-run geo-economic prospects is absolutely essential to sound investing.

March 20, 2013

Visit My New $10M Villa in Cyprus

“NEWS ALERT MARKET WARNING”

Cyprus Rejects Deposit Tax

Click Above for today's Wall Street Journal Article

EU Policy-Makers Look To Future of Cyprus

Cyprus Rejects Deposit Tax

Click Above for today's Wall Street Journal Article

No one voted for what could have been the most devastating economic policy action in over a hundred years anywhere. Wall Street Journal's article sets out further details and is linked above. With the rejection of this plan the country still faces major hurdles in order to avoid bankruptcy - whether a deal can be cut with the Russians remains uncertain. We are consequently withdrawing our stern "Market Warning", but will continue to keep an eye on events, particularly if Cyprus is the first nation to be forced from the EU due to its financial and economic mismangement.

First Financial Insights

March 19, 2013

"Guys, that's not Cyprus! Oh, I get it - another Nauru?"

“MARKET WARNING”

What if your bank shut down, then gave 10% of your (and everyone’s) money to the government? This just happened in Cyprus.

Click Above

This deposit seizure is a very serious matter and policy event that has far-reaching economic and investment implications on a number of fronts; as it sets a dangerous precedent for banks, brokerages, pensions, insurance companies and all other forms and shapes of financial concerns around the world. What happened in Cyprus, could it also occur anywhere in the world - as desperate governments are forced to take harsh illegal actions that violate all forms of commercial law, regulation, ethics and fair economic principles? Who can answer this question now?

Cyprus opens the door to a jackpot of issues that occurs when governments legitimize the outright theft of deposits and assets from bank accounts within their jurisdictions. This is theft of the worst form. For it undercuts the " Rule of International Law " and thereby all confidence in engaging in financial transactions with international bodies or their banking agents. Should this "illegitimate tactic" spread to other European jurisdictions, then the whole financial system could collapse in just a few days, as a panic moves from country to country - and therein; bank to bank.

Let's remember too, that Cyprus is not a third world country under the control of a socio-pathic despot. Its actions appear to have the tacit approval of the EU and ECB. The implications of which place the whole European banking, brokerage and commercial system in "grave jeopardy" - leading to a possible collapse in EU financial markets and systems due to fears of more deposit seizures.

The amount, extent, and rippling effects of the theft of banking deposits or assets by any government is so devastating that immediate measures, sanctions and condemnations must come forward from all world governments, financial institutions and regulatory bodies. Or else we risk seeing the beginning of a wide-spread fear that has the potential to snowball out of control.

Why? Because the question everyone will be asking is: Who's next? Italy? Spain? Greece? Ireland? Portugal? Savvy investors, banks, funds and institutions are sure to start readjusting their positions next week (many did over the weekend no doubt) before the markets open Monday and banks in Cyprus reopen on Thursday. We, hence, expect major outflows and realignments of capital out of marginal EU nations should no counter-measures be applied.

What Cyprus has done is completely unacceptable and thus harsh measures are needed to correct this violation or else the whole global financial system risks a collapse. The problem is that even if measures are taken to fix this immediately; it has created a "whole new fear or risk" in the minds of investors regarding the safety of funds in banks and institutions in Europe, - or perhaps everywhere. This is the last type of policy action one could imagine in such a fragile economic environment. Markets are sure to respond with deep concern.

This is potentially far worse than the crisis that was caused by the Lehman Bros fiasco and we have consequently issued a Market Warning to all our clients, readers and followers for this week. Of course, we will be following and commenting on events as they unfold.

So, we too say, "Be careful out there"

INVESTORS' INSIGHTS

First Financial Insights

March 17, 2013

GAME CHANGER -

When Integrity is Lost